One of the interesting things to witness over the years has been the development of crypto laws around the world. As crypto went from being a novel concept that few had heard of to disrupting the financial world, different countries took different approaches to regulating it. Some countries have been especially welcoming of cryptocurrency, while others have been overtly hostile. But how does Ireland fare? A lot of the attention towards crypto regulation in Europe tends to centre around the Nordic countries, but Ireland has some interesting crypto laws in place.

Legal Status

One way that various countries’ treatment of crypto differs is its legal status. In some countries, crypto is recognised as legal tender, and in others, it is banned entirely. Ireland’s regulation is somewhere in the middle of the two extremes; it is legal to use within the country, but it has not been granted the status of legal tender.

According to the website of the Central Bank of Ireland, cryptocurrency struggles to meet the three functions needed to be considered currency: store of value, unit of account, and medium of exchange. This is mostly credited to the volatility of the crypto market, as well as the slow transaction speeds and high transaction costs. And while it is legal to use crypto in Ireland, the government hasn’t yet created specific financial departments that exclusively handle crypto, though there are currently plans for the release of a central bank digital currency, dubbed the digital euro, at some point in the future.

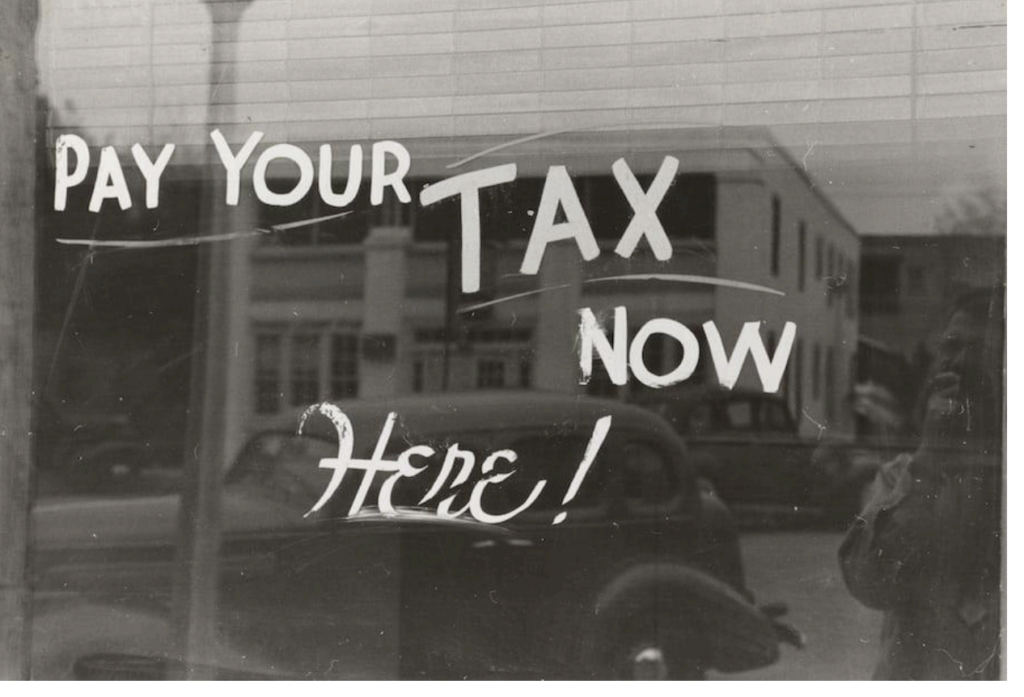

Taxation

As we’ve established, crypto is not considered currency by the Irish government. For taxation purposes, it is looked at as an asset and is subject to capital gains tax at a rate of 33%. Those who hold crypto year-to-year are not necessarily subject to market re-evaluation, as this depends on whether they are being held for resale or investment. When cryptos are sold by a company, however, profits are taxable at a rate of 12.5%.

Cryptos that are gotten from mining are also not subject to tax, and the law is not specific about tokens gotten by airdrop. As for staking, the tokens are taxed based on their market value. Other blockchain-based assets, like NFTs, are also subject to the same taxes as traditional cryptos. Needless to say, Ireland has a fairly robust crypto taxation system that takes into account the different ways that digital assets are gotten, used, and traded.

Business Regulation

Because crypto is legal in Ireland, there are many businesses that deal with it, whether these are exchanges, payment processors, crypto custodians, and so on. And the laws in the country reflect this, with some existing regulations that they have to follow.

Companies that plan to offer any of these services have to register as Virtual Asset Management Service Providers with the Central Bank of Ireland and comply with current anti-money laundering and terrorist financing legislation. To do this, the company has to appoint both a compliance officer and a senior executive, whose job it is to supervise these measures. Companies also have to conduct risk assessments for their operations and due diligence for any customers that they serve. If it suspects that a customer is engaging in illegal activities, they have to report this to the appropriate authorities.

All their staff must also receive anti-money laundering and terrorist financing training, and if any of these requirements are not met, such a company risks losing its status with the Central Bank of Ireland. And, of course, this is all on top of the tax regulations they must adhere to.

Gambling

Ireland has had a thriving gambling scene for a long time, and the advent of crypto has only added to its popularity. Beyond the physical casinos, there are now sites such as the ones from valuewalk.com that accept crypto. But how do the country’s laws take crypto gambling into consideration?

First, it is worth noting that Ireland has several gambling-related acts in place, such as the National Lottery Act of 2013, the Betting Acts of 1931–2015, the Gaming and Lotteries Acts of 1956–2019, and so on. Gambling is legal in Ireland, but there are not yet specific laws that cover crypto gambling. While this is yet to be addressed, many Irish consumers turn to gambling sites registered outside the country to have their needs met.

As time goes on, it is likely that the Irish government will catch up with the ever-growing demand for crypto gambling and create laws to govern crypto casinos within the country. This means that for consumers, there will be more options to choose from. This, in turn, will help to drive crypto adoption throughout Ireland, which has proven itself to be fairly welcoming thus far.